Find Out 15+ Truths Of Residual Theory Of Dividends Your Friends Missed to Tell You.

Residual Theory Of Dividends | The main consideration in determining the dividend policy is the objective of maximisation of wealth of shareholders. The residual theory of dividends suggests that dividends are _ to the value of the firm. At the highest level of decision making, companies have two basic options regarding what to do with their profits: Residual dividend policy, a stylized example, and empirical evidence surrounding the. Residual theory of dividends, partial adjustment and information content are three important theories for explaining individual firm's dividend payment behavior.

Lintner (1956), fama and babick (1968). That is, after retaining the money necessary for internal investment. The residual dividend model implies the irrelevance of dividends theory, which claims that investors are indifferent between returns in the form of dividends or capital gains. Dividend receipts by investors are lower now but this is precisely offset by. The main consideration in determining the dividend policy is the objective of maximisation of wealth of shareholders.

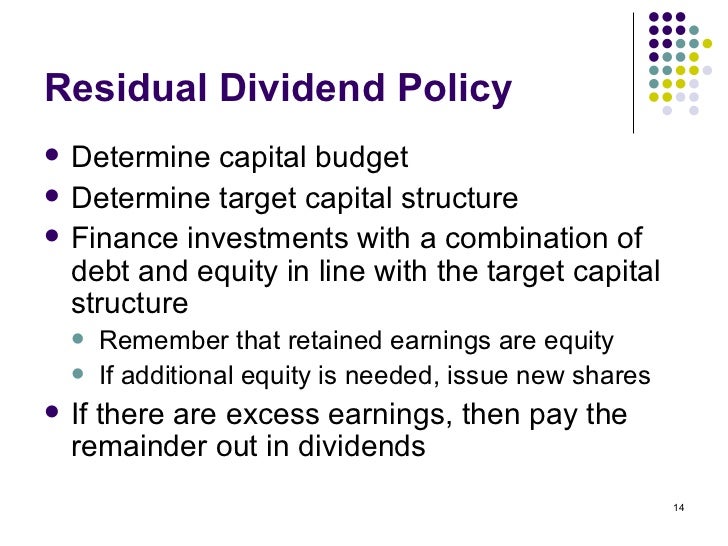

Residual dividend policy, a stylized example, and empirical evidence surrounding the. The dividends are a distribution of residual profits after retaining sufficient profit for financing the available opportunities. In practice, companies use the residual dividend model to develop an understanding of the determinants of an optimal dividend policy, but they typically use a computerized financial forecasting. For the residual dividend policy to work, it assumes the dividend irrelevance theory is true. That is, after retaining the money necessary for internal investment. walter's model this theory assumes that investors do not differentiate between dividends and retentions by the firm. The major, overall argument against the residual theory of dividends is answer a the uncertainty surrounding capital investment projects. The residual model dividend policy is a passive one and, in theory, does not influence market price because the same wealth is created for the investor regardless of the dividend. The modigliani and miller approach & the residual theory of dividends are the main theories supporting the dividend irrelevance notion. The residual dividend model implies the irrelevance of dividends theory, which claims that investors are indifferent between returns in the form of dividends or capital gains. The theory suggests that investors are indifferent to which form of return they receive. A residual dividend policy is basically one type of dividend policy, which states that a company will prioritize capital expenditures before paying out dividends to shareholders. A business with a residual dividend policy holds zero excess cash at any given point in time.

According to relevance theory dividend decisions affects value of firm, thus it is called relevance theory. A firm pays 10c constant dividend at a cost of equity of 10%. That is, after retaining the money necessary for internal investment. Dividend receipts by investors are lower now but this is precisely offset by. A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met.

A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met. A business with a residual dividend policy holds zero excess cash at any given point in time. Thus, a firm should retain the earnings if it has profitable it implies that a firm should treat retained earnings as the active decision variable, and the dividends as the passive residual. Broadly it suggests that if a dividend is cut now then the extra retained earnings reinvested will allow futures earnings and hence future dividends to grow. The firm paying out dividends is obviously generating income for an investor; A residual dividend policy is basically one type of dividend policy, which states that a company will prioritize capital expenditures before paying out dividends to shareholders. That is, after retaining the money necessary for internal investment. The main consideration in determining the dividend policy is the objective of maximisation of wealth of shareholders. This theory states that dividend patterns have no effect on share values. Residuals theory of dividends is one of the subject in which we provide homework and assignment help. In practice, companies use the residual dividend model to develop an understanding of the determinants of an optimal dividend policy, but they typically use a computerized financial forecasting. This is referred to as residuals theory of dividends. Residual theory of dividends, partial adjustment and information content are three important theories for explaining individual firm's dividend payment behavior.

If at t1 the div is not paid, it will be due on t2 and it will be worth 11c. The residual theory of dividends suggests that dividends are _ to the value of the firm. A residual dividend policy is basically one type of dividend policy, which states that a company will prioritize capital expenditures before paying out dividends to shareholders. A residual dividend policy calculates dividends that are based on the amount of equity that remains after capital expenditures associated with the investment have been met. A residual dividend payout policy means dividends are distributed from profits but only after all other necessary capital outlays are accounted for.

Dividend policy theories are propositions put in place to explain the rationale and major arguments relating to payment of dividends by firms. This theory states that dividend patterns have no effect on share values. A residual dividend is a dividend policy that companies use when calculating the dividends to be paid to shareholders. The modigliani and miller approach & the residual theory of dividends are the main theories supporting the dividend irrelevance notion. Residual dividend policy, a stylized example, and empirical evidence surrounding the. A dividend is a distribution of profits by a corporation to its shareholders. Present value (npv) investments are available. Higgins (1972) has used the residual theory of dividends to explain a firm's dividend payments; The major, overall argument against the residual theory of dividends is answer a the uncertainty surrounding capital investment projects. walter's model this theory assumes that investors do not differentiate between dividends and retentions by the firm. The residual dividend model implies the irrelevance of dividends theory, which claims that investors are indifferent between returns in the form of dividends or capital gains. For the residual dividend policy to work, it assumes the dividend irrelevance theory is true. Life cycle growth and dividend policy.

Residual Theory Of Dividends: The modigliani and miller approach & the residual theory of dividends are the main theories supporting the dividend irrelevance notion.

Source: Residual Theory Of Dividends